Gambling Winnings Subject To Self Employment Tax

- Are Lottery Winnings Subject To Self Employment Tax

- Gambling Winnings Subject To Self Employment Taxes

The following types of earnings income (or losses) do not countas earnings from employment or self-employment under the earningstest:

Any income from employment or self-employment earnedin or after the month the individual turns FRA;

Any income from self-employment received in a taxableyear after the year the individual becomes entitled to benefits.Such income must not be attributable to services performed afterthe first month of entitlement to benefits;

Note: This income is excluded from grossincome only for purposes of the earnings test.

Damages, attorneys' fees, interest, or penalties paid under court judgment or by compromise settlement with the employerbased on a wage claim;

Note: Any back pay recovered in a wageclaim does count for the earnings test.

Payments to secure release of an unexpired contractof employment;

Certain payments made under a plan or system established for making payments because of the employee's sickness or accident disability, medical or hospitalization expenses, or death (see §1311);

Payments from certain trust funds that are exemptfrom income tax (see §1314);

Payments from certain annuity plans that are exemptfrom income tax (see §1316);

Pensions and retirement pay;

Sick pay if paid more than six months after the monththe employee last worked;

Payments-in-kind for domestic service in the employer's private home for:

Agricultural labor;

Work not in the course of the employer's trade or business; or

The value of meals and lodging furnished under certain conditions;

Rentals from real estate that cannot be counted in earnings from self-employment. For instance, the beneficiary didnot materially participate in production work on the farm, the beneficiarywas not a real estate dealer, etc.;

Interest and dividends from stocks and bonds (unlessthey are received by a dealer in securities in the course of business);

Gain or loss from the sale of capital assets, or sale, exchange, or conversion of other property that is not stock in tradenor considered inventory;

Net operating loss carry-over resulting from self-employmentactivities;

Loans received by employees unless the employees repaythe loans by their work;

Workers' compensation and unemployment compensation benefits and strike benefits;

Veterans' training pay or allowance;

Pay for jury duty;

Payments for achievement awards, length of serviceawards, hobbies or prize winnings from contests, unless the personenters contests as a trade or business;

Tips paid to an employee that are less than $20 amonth or are not paid in cash (see §1329);

Payments by an employer that are reimbursement specificallyfor travel expenses of the employee and are so identified by theemployer at the time of payment;

Payments to an employee as reimbursement or allowancefor moving expenses, if they are not counted as wages for SocialSecurity purposes (see §1333);

Royalties received in or after the year a person turns FRA. The royalties must flow from property created by the person'sown personal efforts that he or she copyrighted or patented beforethe taxable year in which he or she turned FRA;

Note: These royalties are excluded fromgross income from self-employment only for purposes of the earningstest.

Retirement payments received by a retired partnerfrom a partnership provided certain conditions are met (see §1203);

Certain payments or series of payments paid by anemployer to an employee or an employee's dependents on or after theemployment relationship has ended due to:

Death;

Retirement for disability; or

Retirement for age.

The payments are made under a plan established by the employer(see §1319); and

Payments from Individual Retirement Accounts (IRA's)and Keogh Plans (see §1338).

Last Revised: Aug. 27, 2009

Taxes are probably the last thing on your mind during an exciting gambling session. However, they inevitably come up following a big win or profitable year.

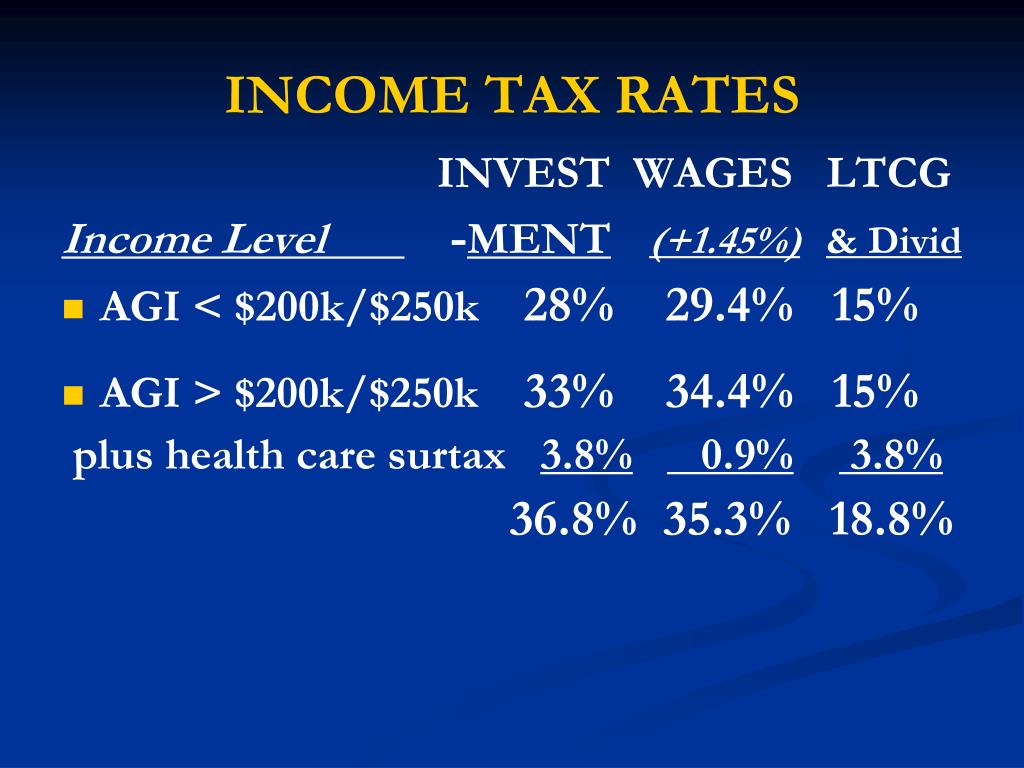

This week’s post about the self-employment tax begins the discussion regarding how the IRS gets its bite on those winnings. To professional gamblers and poker coaches, the self-employment tax is a big player. Self-employment tax is a social security and Medicare tax. The net profit calculated on Schedule C transfers to Form 1040, Line 12 and to Schedule SE for purposes of calculating self-employment (SE) taxes. The SE tax is reported on Form 1040, Line 56. You can also deduct one-half of your self-employment tax when figuring adjusted gross income.

You may have two main questions at this point:

- Do I need to pay taxes on my wins?

- If so, how much do I have to pay?

The following guide discusses whether your gambling wins are taxable and other important topics regarding this subject.

The Short Answer Is Yes

I’ll cut right to the chase: yes, you do need to pay federal taxes on gambling winnings in the United States. This is especially true when you net a big win and receive a W-2G form.

Are Lottery Winnings Subject To Self Employment Tax

According to the IRS, a gambling establishment should issue a W-2G when you win an amount that’s subject to federal income tax withholding (24% of win).

Slot machines present a famous example of when you’ll receive a W-2G form after winning so much. Casinos must issue a form when you win a prize worth $1,200 or more through slots or video poker.

As for the second point, a sportsbook or racetrack must withhold federal taxes when you win a bet worth 300x your initial stake. If you wager $5 and win $3,000, for example, then the bookmaker will issue a W-2G form and withhold $720 (24%).

Here’s a broader look at the W-2G and tax withholding threshold for different types of gambling:

- $600+ through sportsbooks and racetracks (provided it’s 300x your stake).

- $1,200+ through a slot machine, video poker machine, or bingo game.

- $1,500+ through keno.

- $5,000+ through a poker tournament.

All Winnings Are Subject to Taxation

Technically, you’re supposed to report any gambling winnings—big or small. Even if you win $20 in an office betting pool, the IRS wants to know about it.

If you want to stay above board, then you should report all wins on Form 1040 (under “other income”). As I’ll cover later, you can deduct losses from winnings as well.

Furthermore, any amount that’s withheld by a casino, poker room, sportsbook, or racetrack is deducted from what you owe. Gambling establishments keep 24% of a win when they do withhold money.

W-2G Forms Don’t Apply to Table Games

You’ll receive a W-2G when earning big wins through most types of gambling. However, casino table games are an exception to the norm.

Unlike a jackpot game (e.g. video poker) or a poker tournament, casinos have no idea how much money you start with in a table game. Therefore, they can’t really determine when you do and don’t experience big wins.

Examples of table games that are exempt from W-2G forms include:

- Baccarat

- Blackjack

- Caribbean stud

- Craps

- Roulette

- Three-card poker

The IRS still expects you to pay taxes on profits earned through table games. Again, though, the casino can’t issue a W-2G because they can’t tell how much money you’ve actually won.

Some States Tax Gambling Winnings

Most states tax your income, including gambling winnings. Depending upon where you live, you’ll probably need to pay taxes to both the IRS and your state.

For Example:Michigan features a 4.25% flat income tax. The Wolverine State expects you to pay this same 4.25% rate on gambling wins.

West Virginia, on the other hand, doesn’t tax your winnings. Casinos/sportsbooks in the Mountaineer State only withhold federal taxes (when necessary).

Assuming you travel to another state to gamble, you may have two states wanting taxes. Luckily, though, you won’t be subject to double taxation.

Instead, your home state will give you credit for whatever taxes are paid to the state where the winnings occurred.

Can You Deduct Losses?

You can deduct gambling losses from winnings. However, these deductions are itemized rather than standard deductions.

Here’s an example to explain:

- You win $5,000 through sports betting.

- You lose $4,500.

- You must report the full $5,000—not $500 (5,000 – 4,500)—under other income.

- Meanwhile, the $4,500 is reported through various itemized deductions.

In short, itemized deductions are expenses that reduce your taxable income. The standardized variety includes flat-dollar, common deductions.

You may be able to save more money through itemized deductions. However, standard deductions are easier to deal with and also have the potential to save you more money.

Gambling Winnings Subject To Self Employment Taxes

Regardless, you must use itemized deductions when dealing with losses. This means spending more time on your tax returns or working with an accountant.

Keep in mind that you won’t receive a tax refund for gambling losses. Instead, you can only deduct an amount equal to your winnings each year. If you win $3,500, for example, then you can’t deduct more than $3.5k and expect a return.

Keep Records on Wins & Losses

The IRS may take your word at face value when it comes to gambling. Of course, they also have the ability to audit you when they deem it necessary.

That said, you don’t want to guestimate on your wins and losses. Instead, you want proof through the form of records.

Journals offer a great way to record your gambling activities. You can log the following for each entry:

- Date of gambling session

- Location of the establishment

- Game played

- Starting bankroll

- Ending bankroll

Such entries don’t guarantee you’re being honest. However, they at least show the IRS that you’re making a legitimate attempt at recordkeeping.

You can take your recordkeeping efforts even further by holding onto any other relevant documents. Betting slips, winning tickets, canceled checks, bank statements, W-2G forms, and anything else of relevance are all worth saving.

What Happens If You Don’t Report Gambling Winnings?

The IRS fully expects you to report gambling winnings and especially annual profits. They don’t take kindly to you failing to report these wins.

Of course, you’re unlikely to draw an audit for winning a $25 sports bet. You stand a higher chance of being audited, though, if you win enough for a W-2G form.

In this case, the casino/sportsbook/racetrack also sends a copy of the from to the IRS. The latter features reliable software that can match up your reported income with documentation of nonreported income.

Assuming you fail to report gambling winnings, then the IRS may do little more than send a letter and issue a small fine. You should definitely pay up, or at least work out a payment plan, in this case.

You’ll face more serious consequences, though, if you fail to report a huge win and lie about the matter when/if caught. Refusal to pay and/or heavy efforts to cover up the deceit will lead to bigger fines and possibly jail time.

Gamblers Stand Increased Chances of an Audit

Nobody likes attracting an audit from the IRS. Unfortunately, the chances of being audited increase for gamblers.

This is especially true when you net a big win and receive a W-2G. Of course, you can reduce the odds of being audited by claiming anything on the form.

The IRS may also become suspicious if you claim big losses on your tax return. You’ll put the taxman on increased alert when winning a huge prize (e.g. $50,000) and claiming a matching amount of losses.

Also, you can’t write off hotel stays, meals, and entertainment as a casual gambler. You must be a professional to claim such itemized deductions.

How Do Professional Gamblers Report Winnings?

Pro gamblers claim winnings on Schedule C as a self-employed person rather than as other income on Form 1040.

Even as a professional, you can’t deduct more losses than winnings in a year. You’re stuck in a tough situation with treating gambling as a day job, yet not being able to file losses that exceed winnings.

As mentioned before, though, you’re able to deduct business expenses like hotel stays and meals. These expenses just need to be a legitimate part of your business.

Conclusion

In answer to the original question, yes, you’re supposed to claim real money gambling winnings on federal tax forms. Even if you end up losing money on the year, the IRS wants to see your wins and losses.

Of course, tax collectors don’t care a great deal when you win $200 on the year. They spend most of their time looking for bigger winners.

The times when you want to be especially diligent in this matter include:

- When you book a large win and receive a W-2G form.

- If you win a significant amount of profits throughout the year.

- When you win 600x your bet with a sports or horse wager.

Again, the IRS and your state (if applicable) expect all gambling winnings to be reported. But you can use some commonsense in deciding when reporting wins are truly necessary.

Please enable JavaScript to view the comments powered by Disqus.